Intelligent Checking

Access to your money any time, from anywhere.

At Star of Texas, your ability to save money is supported by tools allowing you to MANAGE, ACCESS and SECURE your money!

Manage Money

-Mobile Banking

-Text Banking

-E-Statements

-Wire Transfers (See information below)

-Payroll Deduction

Access Money

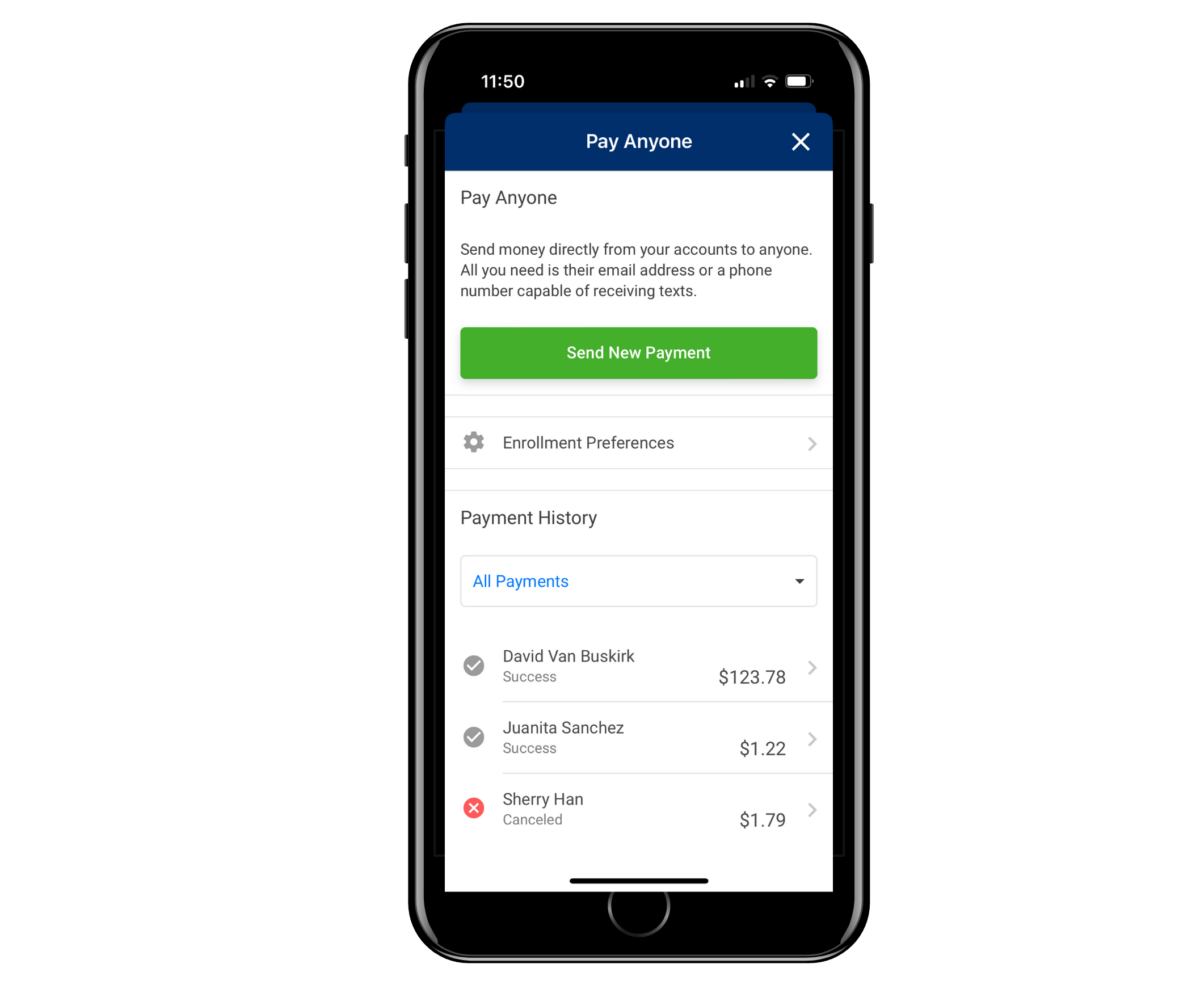

-Person-to-Person Payments

-Mobile Deposit

-Direct Deposit

-More than 30,000 Free ATMs

-Access to over 5,000 branches

Security

-Debit Card Control

-Text Alerts

-Overdraft Protection

-Courtesy Pay

NEW 4 Star Rewards Checking

Reward Yourself with a 4 Star Checking Account!

- Earn 4.00% APY* on balances $0.01 to $15,000 1

- No minimum checking balance or monthly service fee

- Mobile Card Manager for your debit card

- Unlimited check writing

- Nationwide Access to Shared Branching

How to Earn High Yield Rewards 1

- $500 in qualifying deposits into your rewards checking account

- 10 or more qualifying SOTCU rewards debit or credit card transactions

Other Membership Benefits Include

- Nationwide Shared Branching with access to over 5000 credit unions

- Free Mobile App – including Mobile Deposit, Text Banking, and More (available in the Apple & Google Play Stores)

- Free ATMs in the Austin – Over 175 in the Austin area via the Austin Alliance of ATMs (https://www.freecuatms.org/index.cfm).

- Specialized ITIN Lending Program & other Loan Products & Services to meet your needs!

Intelligent Checking

Open your Intelligent checking account with Star of Texas Credit Union today and take advantage of the following special member features:

- No monthly service fees

- No minimum balance requirement

- No per-check fees and no monthly service charge

- Unlimited check writing

- FREE Home Banking and Mobile Banking

- FREE Bill Pay*

- FREE VISA Check Card

- FREE Access to more than 30,000 ATMs Nationwide

- Courtesy Pay**

- E-Statements

- Love My Credit Union Rewards: Discounts available for CU Members!

- Nationwide Shared Branches. Visit www.co-opsharedbranch.org or call 888-748-3266 to find a location near you!

Opening an account is quick and easy! Click the button below to fill out the paperwork online and get approved within minutes! ***

* Bill Pay service is free when actively utilized. Monthly inactivity fee of $3.00 is assessed if no payments are processed during the month.

**Accounts must be opened 90 days and in good standing to be eligible for Courtesy Pay. The account must remain open for 90 days to avoid a $10 early closure fee and the $25 will be forfeited. Other restrictions may apply. ***If you application isn’t auto-approved, don’t worry, a credit union representative will follow up with you to help complete your membership.

Mobile Banking

Access your account on your smartphone anytime, anywhere by signing up for Mobile Banking.

- Mobile Deposit Capture

- Mobile Browser Banking

- Text Message Banking

- Alerts

- Fund Transfers

- Account Balances

- Bill Pay Services

- Transaction History

To get started, log onto your Home Banking account and click on Mobile Money under Additional Services from the Self Service tab. Follow the prompts to complete your enrollment.

Shared Branching

What is Shared Branching?

Shared Branching is a cooperative network of credit unions sharing over 5,600 locations nationwide. No matter if you are across town, move, travel, or away to college on the other side of the country, with Shared Branching, you can easily access your credit union.

Standard member services offered at shared branch facilities include:

- Deposits

- Withdrawals*

- Transfer funds between accounts*

- Loan Payments*

Here is what you need to take with you to a shared branch:

- The exact name of your credit union

- Your account number(s)

- Valid photo identification

*Some restrictions apply

Credit Unions Are Better Together!

Access ATMs all around Austin without having to pay fees! The Alliance of Austin Credit Unions is a cooperative program allowing members to access ATMs without additional service fees or charges. This is a convenient member benefit that we encourage you to utilize!

We are proud to be a part of the Alliance of Austin Credit Unions

- A+ FCU

- Aggieland CU

- Amplify CU

- Austin CU

- Austin FCU

- Austin Telco FCU

- Capitol Credit Union

- GEFCU Austin

- Greater Texas FCU

- LCRA CU

- Public Employees CU

- Star of Texas Credit Union

- Texas DPS CU

- Texas Health CU

- United Heritage CU

- University CU

- Velocity CU

*APY=Annual Percentage Yield. Earn up to 4.00% APY on balances from $0.01 to $15,000.00. On amounts of $15,000.01 and greater, the posted Checking account rate applies. Earning dividends on a Star of Texas Credit Union “4-Star” high-yield checking account requires: 1. A minimum of $500.00 in monthly deposits to the account, and 2. You must have (10) ten or more debit card transactions on account per month. “Per month” is based on the calendar month period. There are no monthly service fees on this account regardless, even if the account does not meet minimum “qualified dividend status.” If the account does not meet minimum earning requirements, dividends are forfeited but no monthly service fee is incurred. You can track your “Qualified Dividend Status” monthly via our Star of Texas Credit Union – Mobile App (available for free download via the Apple or Google Play Store). Please note: This account does not include check writing privileges and does not come with any checks. Earning potential and “qualified dividend status” resets on the first calendar day of each month. Dividends are posted on the last calendar day of the month and are based on the average monthly balance. Monthly deposits can consist of cash, checks, and/or mobile deposits. Account and membership must remain in “good standing” to qualify for and maintain a “4-Star” Rewards Account. Accounts subject to approval. Offer may be revoked or changed with or without notice based on any adverse activity, such as account fraud, etc. either directly or on any associated Joint accounts. Standard account fees still apply as disclosed in our most current Fee Schedule. Fees could reduce earnings. APY is effective as of 10/24/2023. Overall program, rewards, terms, and conditions subject to change without notice. Accounts are variable rate accounts and rates are subject to change at any time without notice. Speak to a credit union representative for complete details.